Securing digital payments with AI-powered fraud detection

At a glance

Together with Google Cloud Consulting, we helped Sionic infuse its real-time, bank-to-bank payments with the AI intelligence and expertise needed for superior fraud detection.

Impact

With Slalom’s expertise and Google Cloud’s AI technology, Sionic is creating the next generation of digital payments, bringing to market an advanced fraud detection service that protects consumers and retailers.

Key Services

Industry

Banking & payments

Key Technologies / Platforms

- Google Cloud

- Vertex AI Studio

- BigQuery

- Cloud Run

Setting a standard of trust for real-time transactions

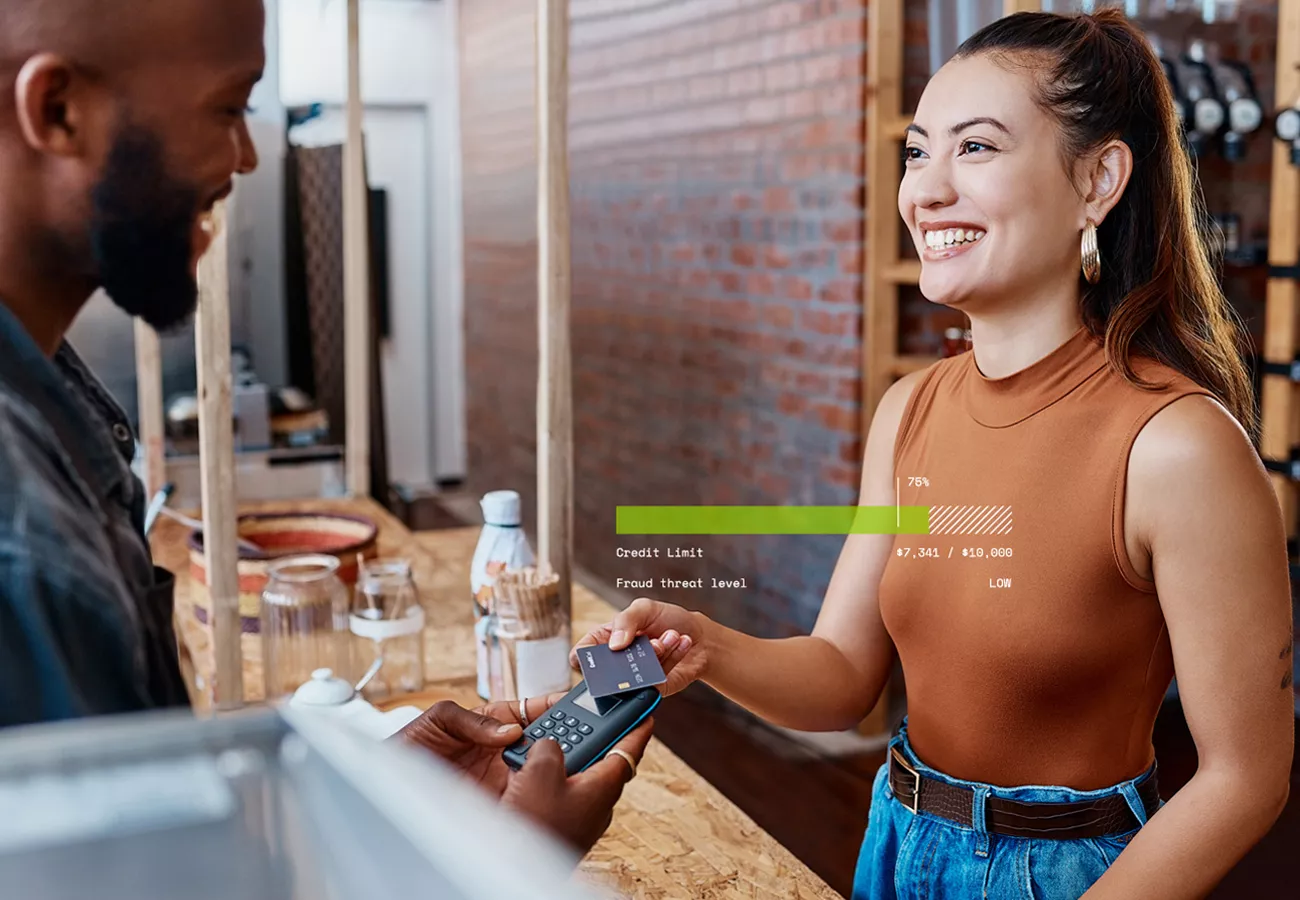

In the ever-evolving landscape of digital payments, Sionic has set out to pioneer the future. Founded in 2010, the company initially began in the mobile commerce loyalty and rewards space. Now, 14 years later, Sionic has transitioned its expertise to an adjacent frontier: real-time, bank-to-bank payments at the point of sale. This strategic move aims to empower financial institutions and retailers by offering a seamless and secure payment solution that caters to small and large businesses.

When planning its new payment solution, Sionic recognized the need to address the growing incidence of fraud plaguing the payments industry. With a commitment to innovation, security, and trust, Sionic’s leaders knew that offering a robust fraud detection and mitigation capability would be necessary.

Powering AI through a collaborative partnership

To help financial institutions, merchants, and consumers enjoy the advantages of instant bank payments without the fear of fraud, Sionic engaged Slalom and Google Cloud Consulting to collaborate on an advanced fraud detection system driven by artificial intelligence and machine learning (AI/ML).

“The genesis for this initiative comes out of the fact that we’ve built a real-time payment solution within the Google Cloud ecosystem,” shares Matthew Watson, chief technology officer of Sionic. “We met with Google Cloud engineers and determined that our best way forward was to employ modern AI technologies leveraging the Vertex AI platform.”

Vertex AI, a unified development platform for building and using generative AI, implemented in combination with Google Cloud’s BigQuery and Cloud Run, would allow Sionic to develop inference and training pipelines that could analyze payment transaction data, evaluate the level of fraud threat, and determine whether a transaction should be processed.

However, since Sionic’s payments platform had not yet been released, there was no existing data to fuel the ML models. With Google Cloud Consulting focused on the system’s technical application, Sionic leveraged Slalom’s fraud domain expertise and Google Cloud’s engineering expertise to develop the AI-based synthetic data that would support the training of these models.

Infusing intelligence and financial consulting expertise into the battle against fraud

For reliable and effective fraud detection models, Slalom needed to define the types of fraud and characteristics that should be targeted and accurately reflected in the datasets. To do so, we identified, refined, and prioritized the fraud use cases that overlapped between small businesses and enterprise merchants. We then leveraged industry best practices to provide crucial feedback and examples that guided the parameters for generating synthetic data.

From there, we advised on baseline guardrails around the ML models to eliminate obvious cases of fraud and improve model training. We also introduced a rules engine to mitigate the cost of running these models.

Based on our guidance, the team of Google Cloud engineers could then generate millions of fraudulent and non-fraudulent transactions to effectively train the ML models.

Securing the future of payments

Looking ahead, Slalom has equipped Sionic with the knowledge and tools needed to iterate on its ML model as the company onboards new customers and matures its fraud detection offerings. This continuous improvement approach will ensure that Sionic stays ahead of evolving fraud tactics and maintains comprehensive security measures.

“The depth and breadth of Slalom’s knowledge was a tremendous asset,“ Watson states. “Their team gave us a good, solid baseline and foundation that Sionic can now grow on and scale out as we move into a production footprint.”

The partnership between Slalom and Sionic has laid the groundwork for an advanced, scalable fraud detection system poised to revolutionize real-time payments long into the future. Ultimately, this collaboration will lead to a more secure and efficient payment landscape, enabling financial institutions and retailers to strengthen customer relationships and minimize disputes while also positioning Sionic for continued success in its industry.